Tax Preparation Overview

Read this helpful guidance: 2023 Tax Filing Guide

Tax Preparation is a Multi-Step Process!

- Check “snail” mail and e-mail for potential tax forms (usually sent January-March)

- Check your school email in January/February for a code to complete free federal tax filing through a software for nonresidents (Sprintax)!

- Follow the instructions for Sprintax!

Frequently Asked Questions

While the COF offers resources to you, please note that we are NOT tax experts and cannot provide direct tax advice. Our role is to provide contracted resources (via Sprintax – a COF business partner), so that you can complete your taxes yourself subject to their terms and conditions (found by clicking here).

How do I send in my tax forms to the IRS (Internal Revenue Service)?

Based on whether you are able to file taxes and Sprintax generates a form 1040 or you qualify as exempt and send in an 8843 you will need to send a self addressed envelope via postal carrier of your choice (USPS recommended) to the IRS with your forms.

Below are links on where to mail your documents based on your status as well as instructions on how to address your document and mail it off.

Where to send:

https://www.irs.gov/filing/where-to-file-paper-tax-returns-with-or-without-a-payment

https://www.irs.gov/filing/where-to-file-forms-beginning-with-the-number-8

How to send:

https://www.usps.com/ship/letters.htm

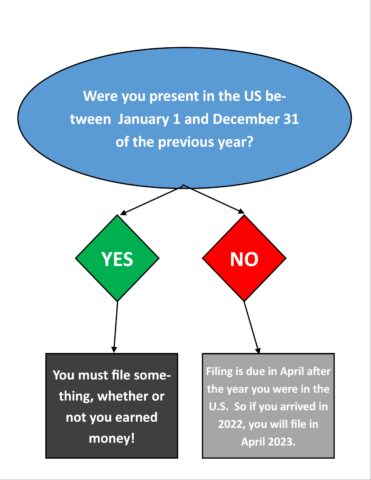

Who has to file documents?

- Everyone!

- All international students, exchange visitors, and foreign workers must file documents to the United States government every year, even if you did not earn or receive money.

When do I have to file documents?

- Tax paperwork must be completed and filed by April 15th of the year following any period during which you resided in the U.S.

- For example: If you were in the U.S. at any point between January to December of a given year, you must file by April 15th of the following year.

I would like help filing my federal and state personal income tax documents. How do I begin the process of filing my paperwork?

- The COF has jointly purchased Sprintax for our international student, scholar, and exchange visitor population to assist with personal income tax forms. (Don’t worry – you do not need to understand the U.S. tax system!). Note that the Federal preparation is free of charge, but you will need to pay our Sprintax business partner if you choose to use it for state tax preparation.

- Alternatively, you can try to fill out your tax forms on your own:

I need tax advice/I have questions that are not answered here. How can I get more help or speak with someone in person?

- Our COF business partner, Sprintax, has a plethora of information including a YouTube Channel, Blog, and a 24-hour live chat feature for specific tax advice and well as software assistance. Create your account today at https://taxprep.sprintax.com/fenway

- Visit a Taxpayer Assistance Center (TACs), or Volunteer Income Tax Assistance (VITA) site

- Find your closest TAC here: http://www.irs.gov/uac/Contact-My-Local-Office-in-Massachusetts.

- VITA site details: https://www.irs.gov/individuals/free-tax-return-preparation-for-qualifying-taxpayers

- Including this site in Chestnut Hill: https://freetaxprepinc.org/

- VITA site details: https://www.irs.gov/individuals/free-tax-return-preparation-for-qualifying-taxpayers

- Find your closest TAC here: http://www.irs.gov/uac/Contact-My-Local-Office-in-Massachusetts.

- Check out the US Tax Guide for Aliens: http://www.irs.gov/pub/irs-pdf/p519.pdf

I neglected to file my tax documents in past years and would like to file documents for more than one year. What should I do?

- You can use our tax preparation software to file federal and state taxes for a limited number of prior years. Click https://taxprep.sprintax.com/fenway to access this software.

- Contact the Taxpayer Assistance Center mentioned in the question above.

I have applied to immigrate to the U.S. What should I do?

- If you have applied to adjust your immigration status to permanent resident (i.e. you have applied for a “green card” or “permanent resident” card), you should seek the advice of an immigration attorney before filing tax documents.

Am I a resident or nonresident for tax purposes?

- Our tax preparation software will help you determine this! Click here to get started!

- Watch this helpful Residency Status video from Sprintax!

- You may also check the IRS resources at: http://www.irs.gov/Individuals/International-Taxpayers/Determining-Alien-Tax-Status

I am concerned about financial fraud, scammers and phishing expeditions – how do I know whom to trust?

- No legitimate or reputable financial operation (including the Internal Revenue Service or Sprintax) will ask you for your financial details, bank account or personal information via a phone call or email that you did not initiate. Be sure to always carefully follow the instructions to access https://taxprep.sprintax.com/fenway (as described above) and always verify that the resources with which you are interacting are provided directly by Sprintax.